Best practices to use Segmentation

This article should help using segmentations in a reporting solution.

Level | Segmentations | Ordering | Selection | Best Practices / Examples |

|---|---|---|---|---|

Base Segmentations | Base Segmentations are defined by the data sources and typically have too many segments. Still they can be used in any of the below scenarios by adding a short form of derived segmentation | The base segmentations have their natural ordering defined. |

| |

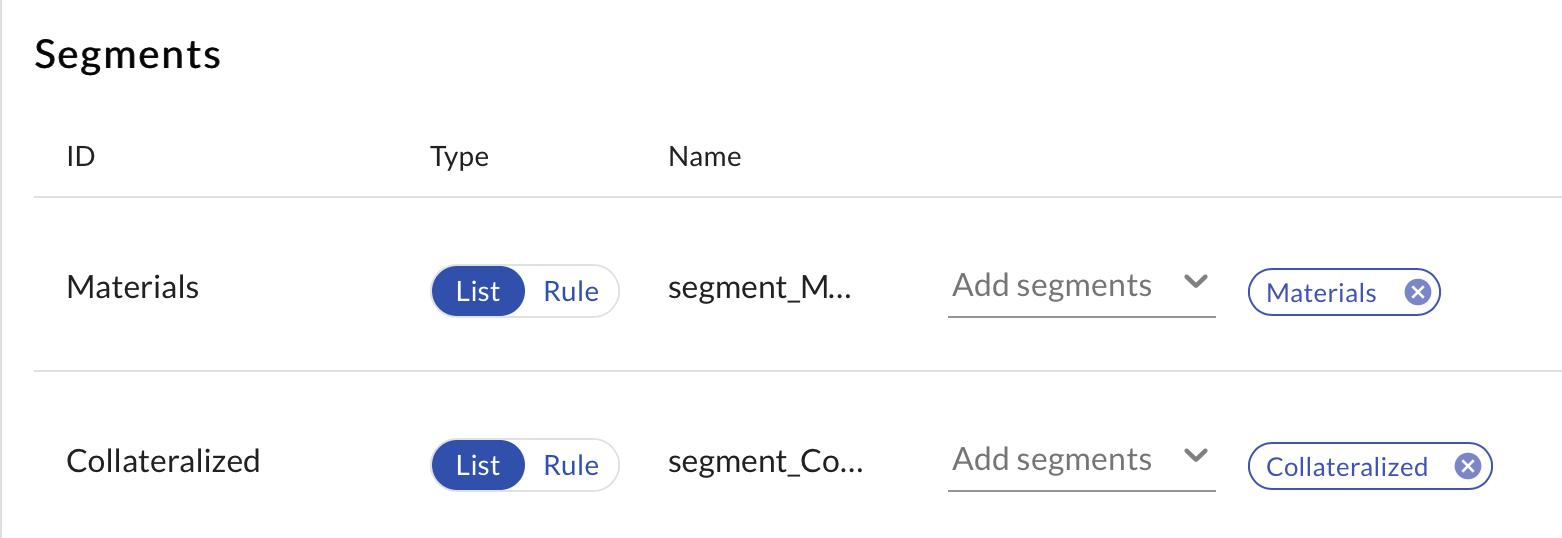

Stored (derived) Segmentations | Segmentations designed with the Segmentation Editor and stored in the solution are typically used to group the assets based on one (or multiple) base or derived segmentations. |

Don’t use any fixed ordering clause here if you want to use the automatic ordering features of building blocks. |

Don’t use |

Use the in operator

CODE

For a negated rule (e.g. not in segmentxyz) you have to use the

JSON

|

Profiles | The profiles define the default segmentations to be used for

|

Don’t use any ordering here if you want to use the automatic ordering features of building blocks. |

Use the short hand form to define derived segmentations in profiles to modify the underlying segmentations to fit the need in charts & tables: use the |

JSON

|

Report-level Building Block |

A this level no changes to the segmentations are done anymore as this would complicate the configuration | |||

Report Types | In a report type the final parameters to a building block can be defined | normally no ordering needed | normally no selection needed |

JSON

|

Building Blocks | The building blocks partially modify the incoming segmentation to

|

| Selection is done based on parameter |

|